What is a Flood Elevation Certificate?

An elevation certificate (EC) is a document needed to confirm a structure’s elevation in relation to the projected height floodwaters might reach in the event of a major flood (especially in high-risk zones). ECs are also used by the NFIP (and some private flood insurance carriers) to provide elevation information necessary to:

- Determine the correct flood insurance rate

- Ensure compliance with community floodplain management ordinances

- Support a request for a Letter of Map Amendment (LOMA) or a Letter of Map Amendment based on fill (LOMR-F)

Who Needs an Elevation Certificate?

For properties or buildings in high-risk flood zones, an elevation certificate might be required if the flood insurance policy is written through a federally regulated insurance lender including the NFIP. This is due to the fact that in high-risk flood zones, there is at least a one in four chance a flood could occur during a 30-year mortgage. Private insurers, however, do not always require ECs – even in high-risk flood zones.

Flood Elevation Certificates are not typically required and are not used for flood zone rating in moderate- to low-risk areas (Zones B, C and X), undetermined risk areas (Zone D), or certain high-risk areas eligible for other subsidies (e.g., Zones AR and A99).

Georgia Flood Insurance can assist you in determining your flood zone and identifying possible lower rates based on recent flood map changes.

When Do You Need an Elevation Certificate?

A copy of your elevation certificate will likely be required when you buy a new property in a high-risk area, are shopping for better premium costs, or if there has been a recent flood zone change in your area.

In high-risk flood zones, NFIP flood insurance policies cannot usually be written without the EC for the property being considered. Though most private carriers may not require an EC to issue a policy, not every home will qualify for

private coverage.

When in doubt, it is always best to have a copy of your EC when you contact Georgia Flood Insurance (or any flood insurance agent) to get flood insurance in high-risk areas.

Curious if your home is in a high-risk flood zone and will require an elevation certificate? A free, no obligation, online quote is fast and easy way to find the answer.

Where Can You Get a Copy of Your Elevation Certificate?

There are a few different ways to get a copy of your EC, including:

- Property Deed.

The EC is sometimes included with this document. - Sellers of the Property You’re Buying.

When purchasing a new home or business, ask the sellers to provide a copy of the EC – especially if the home is classified in a high-risk zone. If they don’t have an EC, ask if they can provide one before the closing. Want to find your property’s flood zone?

Click here>> to get started. - Floodplain Manager.

Every NFIP participating community has a floodplain manager. If they do, your EC might already be on file. - Developer or Builder.

In a high-risk flood zone, the developer or builder may have been required to obtain an EC at the time they built the home. - Hire a licensed land surveyor, professional engineer, or certified architect.

These professionals are able to determine the elevation around the building areas and certify whether or not the area around the property is under or above the prescribed flood elevation. It is important to note there may be fee when you hire these professionals to complete an EC for you. Before you hire one, however, ensure they are authorized by law to certify elevation information.

Why and How is Your

Elevation Certificate Used?

If your home is in a high-risk area (Zones A or V), the EC information is used to determine a risk-based premium for a flood insurance policy anywhere in Georgia. The EC shows the location of the building, the lowest floor elevation, building characteristics, and the flood zone, all factors for the determination

of the premium.

Your insurance agent will also use the EC to compare your building’s elevation to the Base Flood Elevation (BFE). The BFE is the elevation that floodwaters are likely to have a one percent chance of reaching or exceeding in any given year. The higher your lowest floor is above the BFE, the lower the risk of flooding, which typically means lower flood insurance premiums.

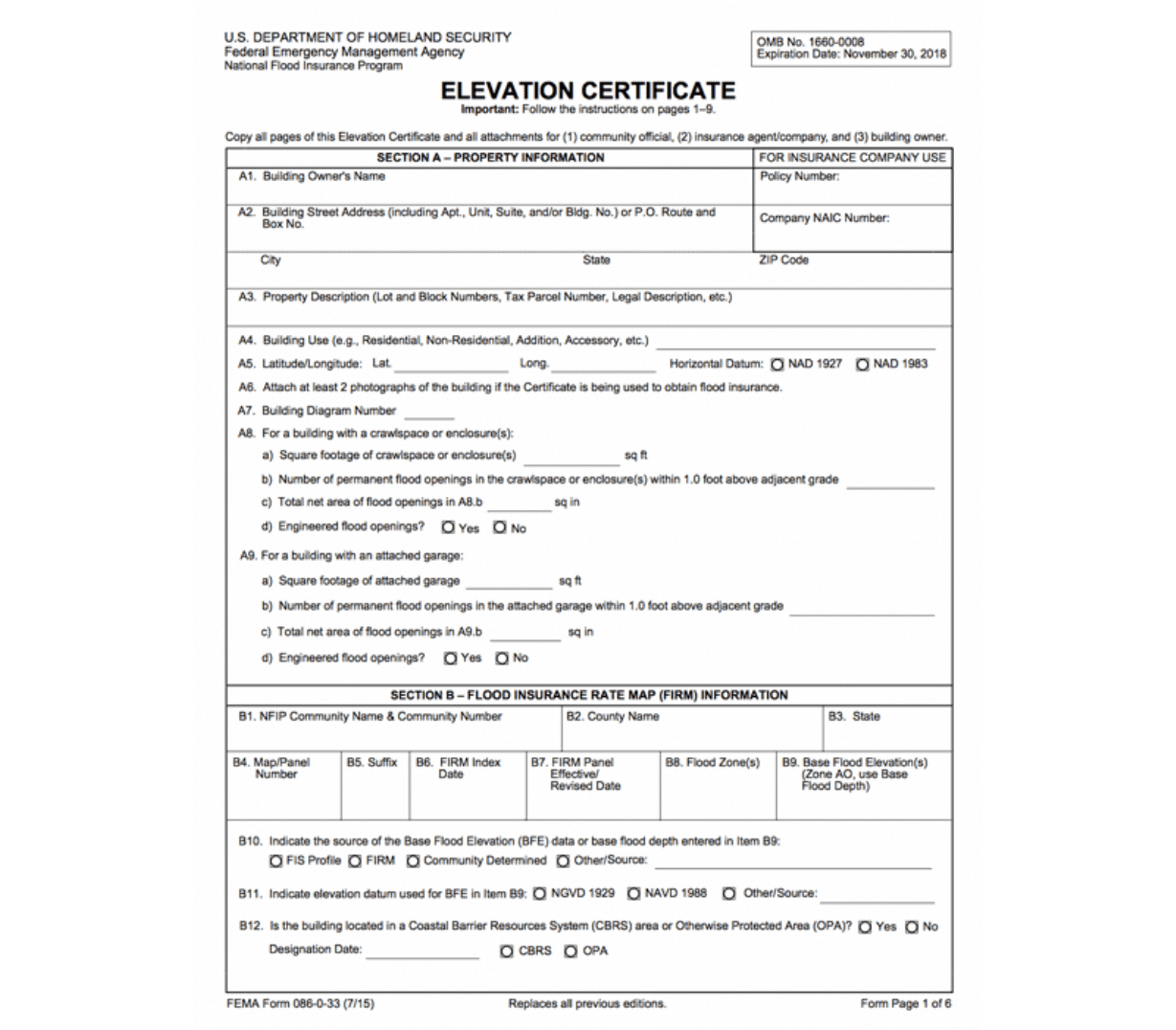

Sample Elevation Certificate

Below is a sample elevation certificate and some of the information

Alabama Flood Insurance will need to write your flood insurance policy.

Click Here for a Full Screen Preview>>